Weight Loss Camps and Programs

Weight loss camps offer structured environments designed to facilitate significant weight loss through a combination of dietary changes, exercise, and behavioral modification. These programs vary significantly in their intensity, duration, and target audience, ranging from short-term outpatient programs to extended residential stays. Understanding the different types of camps and the services they offer is crucial for individuals seeking effective and sustainable weight management solutions.

Types of Weight Loss Camps

Weight loss camps cater to diverse needs and preferences. Residential camps provide a fully immersive experience, removing individuals from their usual environments and placing them in a controlled setting dedicated to weight loss. Outpatient programs, conversely, allow participants to maintain their daily routines while attending scheduled sessions. Specialized programs exist for children and adolescents, addressing the unique challenges of weight management during developmental stages, and adult programs often incorporate more advanced techniques and address the complexities of adult lifestyles.

The choice depends on individual circumstances, commitment level, and available resources.

Services Offered at Weight Loss Camps

A comprehensive weight loss camp typically incorporates a multi-faceted approach. Nutrition counseling provides personalized dietary plans and education on healthy eating habits. Structured exercise programs, often tailored to individual fitness levels, build physical endurance and promote calorie burning. Behavioral therapy addresses underlying emotional and psychological factors contributing to weight issues, equipping participants with coping mechanisms for managing cravings and stress.

Additional services may include medical monitoring, group support sessions, and educational workshops on topics such as stress management and healthy lifestyle choices. Some camps may also incorporate recreational activities to enhance the overall experience and promote a sense of community.

Cost Comparison of Weight Loss Camps

The cost of weight loss camps varies considerably based on several factors, including the program’s duration, location, intensity, and the services provided. Residential programs, being more intensive and requiring accommodation, typically command higher fees than outpatient programs. Specialized programs for children or those incorporating advanced therapies may also incur higher costs. For instance, a week-long outpatient program might cost a few hundred dollars, while a month-long residential program could easily exceed several thousand.

It’s crucial to obtain detailed cost breakdowns from potential programs before making a decision.

Typical Components of Weight Loss Camp Programs

| Camp Type | Program Components | Duration | Typical Cost |

|---|---|---|---|

| Residential (Adult) | Nutrition counseling, fitness training, behavioral therapy, medical monitoring, group support | 4-8 weeks | $5,000 – $15,000+ |

| Outpatient (Adult) | Nutrition counseling, group fitness classes, some behavioral therapy | 8-12 weeks | $500 – $3,000 |

| Residential (Children/Adolescents) | Nutrition education, age-appropriate fitness activities, family therapy, educational workshops | 2-4 weeks | $3,000 – $10,000+ |

| Specialized (e.g., medically supervised) | Intensive medical monitoring, personalized nutrition plans, specialized fitness programs, ongoing behavioral support | Variable | $10,000+ |

Factors Influencing Insurance Coverage

Securing insurance coverage for weight loss programs is highly dependent on a variety of factors. The likelihood of approval hinges on a complex interplay between the individual’s health status, the specific program offered, and the insurance provider’s policies. Understanding these factors is crucial for anyone considering seeking insurance reimbursement for weight loss interventions.Several key elements significantly impact whether an insurance company will cover weight loss programs.

These factors influence the assessment of medical necessity, a critical determinant in coverage decisions. Let’s examine these influential factors in detail.

Medical Necessity and Weight Loss Programs

Insurance companies generally only cover weight loss programs if they’re deemed medically necessary. This means the program must address a pre-existing health condition directly linked to obesity, such as type 2 diabetes, hypertension, or sleep apnea. Simply wanting to lose weight is usually insufficient to qualify for coverage. The program itself must also be structured to be medically sound, usually involving a structured plan of care with regular monitoring by a healthcare professional.

Factors Increasing or Decreasing Coverage Likelihood

A high Body Mass Index (BMI) often increases the chances of coverage, particularly if it’s accompanied by related health complications. Conversely, a lower BMI might decrease the likelihood, as the perceived medical need might be less urgent. A referral from a primary care physician or a specialist strongly increases the chances of approval, as it validates the medical necessity of the intervention.

Pre-existing conditions directly related to obesity, like those mentioned above, significantly enhance the probability of coverage. Conversely, the absence of such conditions and a low BMI might result in a denial of coverage. The type of program offered also plays a role; structured, medically supervised programs are more likely to be covered than standalone weight loss camps.

Examples of Covered and Uncovered Situations

For instance, an individual with type 2 diabetes and a BMI of 40 who receives a referral from their doctor for a medically supervised weight loss program that includes dietary counseling, exercise, and medication management might have their program covered. In contrast, an individual with a BMI of 27 and no health complications who seeks coverage for a general weight loss camp is less likely to be approved, as the medical necessity isn’t as clearly established.

Factors Considered by Insurance Companies

Insurance companies typically consider several factors when evaluating coverage for weight loss interventions. This detailed assessment aims to ensure the program’s medical necessity and effectiveness.

- BMI: A high BMI often increases the likelihood of coverage.

- Pre-existing conditions: Conditions such as type 2 diabetes, hypertension, sleep apnea, and osteoarthritis directly linked to obesity significantly improve the chances of coverage.

- Physician referral: A referral from a primary care physician or specialist strengthens the claim of medical necessity.

- Program structure: Medically supervised programs with structured plans, regular monitoring, and qualified professionals are more likely to be approved.

- Program components: The specific components of the program, such as dietary counseling, exercise plans, behavioral therapy, and medication management, are assessed for their medical relevance.

- Policy details: The specific terms and conditions of the individual’s insurance policy will ultimately determine coverage.

Navigating Insurance Claims for Weight Loss Programs

Successfully navigating the insurance claim process for weight loss programs requires careful planning and meticulous documentation. Understanding your policy, gathering necessary paperwork, and properly submitting your claim are crucial steps to maximizing your chances of reimbursement. This section provides a step-by-step guide to help you through this process.

Submitting a Claim for Weight Loss Camp Expenses

The claim submission process typically begins by contacting your insurance provider to confirm coverage for weight loss programs. This often involves reviewing your policy documents or speaking directly with a customer service representative. Once coverage is confirmed, you will need to gather all necessary documentation and submit it according to your insurer’s guidelines. This usually involves completing a claim form and providing supporting documentation, which will be detailed in the following section.

After submission, you should receive confirmation of receipt and updates on the claim’s status. Regularly checking on the claim’s progress is advisable.

Required Documentation for Claim Support

Supporting your claim requires comprehensive documentation. This typically includes a referral from your physician outlining the medical necessity of the weight loss program, specifically highlighting how the program addresses a diagnosed medical condition (such as obesity or related comorbidities). Detailed program information, including the program’s length, services provided, and total cost, is also essential. Receipts for all expenses incurred during the program, including travel, accommodation, and program fees, must be meticulously retained and submitted as proof of payment.

Finally, any other relevant medical records, such as pre- and post-program evaluations, can strengthen your claim. Ensure all documentation is clear, legible, and accurately reflects the services received.

Interpreting an Explanation of Benefits (EOB)

An Explanation of Benefits (EOB) is a statement from your insurance company summarizing the services billed, the amounts paid, and the amounts you are responsible for. It’s crucial to understand this document. The EOB will detail the total charges, the amount your insurance company paid, any co-pays or deductibles you owe, and any remaining balance. It also often includes codes indicating the reason for any denials or adjustments to the claim.

Carefully reviewing your EOB for accuracy is vital. If you have any questions or discrepancies, contact your insurance provider immediately to clarify. For example, an EOB might show a partial payment due to exceeding the annual out-of-pocket maximum, or a denial due to a lack of pre-authorization.

Common Reasons for Claim Denials and Addressing Them

Understanding common reasons for claim denials can help prevent them.

- Lack of Pre-authorization: Many insurance plans require pre-authorization for specific services, including weight loss programs. Addressing this involves contacting your insurer

-before* starting the program to obtain necessary approvals. - Insufficient Medical Necessity: Your physician’s referral must clearly demonstrate the medical necessity of the program to treat a diagnosed condition. If denied, providing additional medical documentation, such as further physician notes or test results, might help.

- Incomplete Documentation: Missing or incomplete forms, receipts, or medical records are common causes for denial. Ensure all required documentation is submitted with your claim.

- Out-of-Network Provider: If the weight loss camp is not in your insurance plan’s network, reimbursement may be lower or denied. Choosing an in-network provider whenever possible can prevent this.

- Benefit Limits Exceeded: Your plan may have annual limits on coverage for certain services. If your claim exceeds these limits, you may receive partial reimbursement or a denial. Reviewing your policy details will clarify these limitations.

Alternatives and Affordable Options

While weight loss camps can be effective, their high cost often makes them inaccessible. Fortunately, several alternative weight loss methods exist, some of which may be covered by insurance, offering more affordable and potentially equally effective pathways to a healthier weight. These alternatives focus on sustainable lifestyle changes rather than short-term, intensive interventions.Many insurance providers recognize the importance of addressing obesity and its related health complications.

Therefore, they often cover medically supervised weight loss programs that incorporate a multi-faceted approach to weight management. This approach frequently includes a combination of strategies to achieve the most positive and lasting outcomes.

Medically Supervised Weight Loss Programs

Medically supervised weight loss programs typically involve regular check-ups with a physician or registered dietitian, monitoring of vital signs, and personalized guidance on diet and exercise. These programs often include components like nutritional counseling, behavioral therapy, and medication (if appropriate and medically necessary). The level of insurance coverage varies depending on the plan and the specific services provided, but many plans at least partially cover these services, especially if weight loss is medically necessary due to related health conditions like diabetes or hypertension.

A patient’s individual plan and medical history will determine the extent of coverage. For example, a plan might cover 80% of the cost of visits with a dietitian, but only 50% of the cost of prescribed weight-loss medication.

Nutrition Counseling and Behavioral Therapy

Nutrition counseling provides personalized guidance on healthy eating habits, portion control, and meal planning. Behavioral therapy helps individuals identify and address underlying emotional or psychological factors that contribute to overeating or unhealthy eating patterns. Both are frequently covered by insurance, particularly if the individual has a diagnosed eating disorder or related medical condition. Many insurance plans offer coverage for a certain number of sessions per year with a registered dietitian or licensed therapist specializing in behavioral health.

Coverage may depend on factors like the diagnosis and the therapist’s network participation.

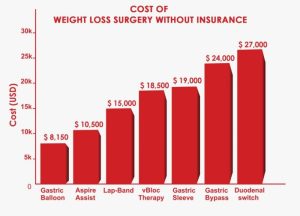

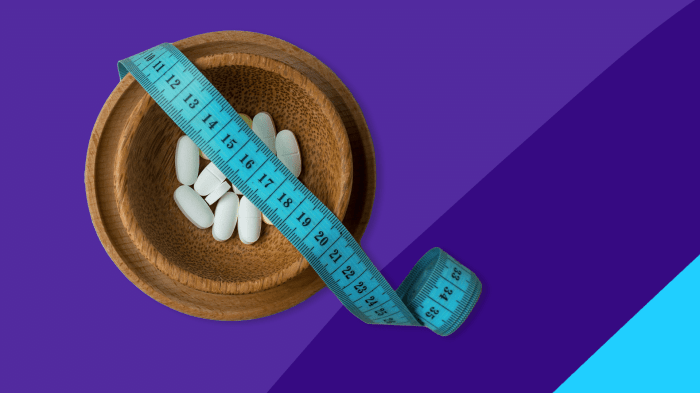

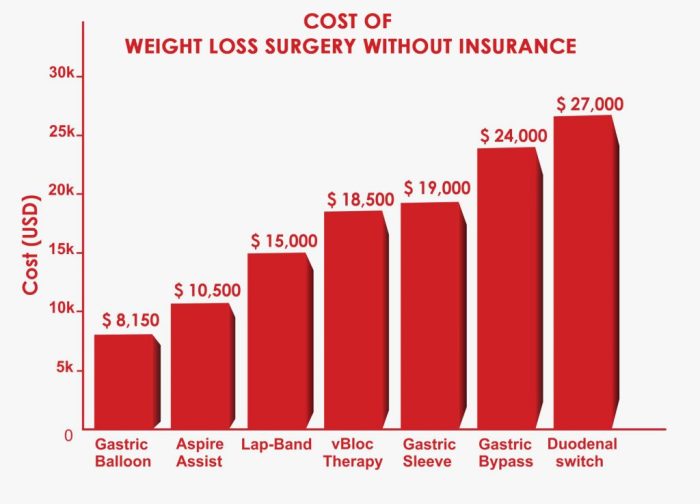

Cost Savings Compared to Weight Loss Camps

The cost of a weight loss camp can range from several thousand to tens of thousands of dollars, often without insurance coverage. In contrast, medically supervised weight loss programs, nutrition counseling, and behavioral therapy can be significantly more affordable, particularly with insurance coverage. While the upfront cost of these alternatives may vary, the long-term cost savings can be substantial, especially when considering the lack of coverage for camps and the potential for recurring expenses.

Comparison of Weight Loss Approaches

The effectiveness of each method varies depending on individual factors such as commitment, adherence to the plan, and underlying health conditions. It is crucial to consult with a healthcare professional to determine the most suitable approach.

| Method | Typical Cost | Insurance Coverage | Effectiveness |

|---|---|---|---|

| Weight Loss Camp | $5,000 – $20,000+ | Generally not covered | Highly variable; depends on program and individual |

| Medically Supervised Weight Loss Program | $500 – $2,000+ per month | Partially to fully covered, depending on plan and services | Moderate to high, with consistent monitoring and support |

| Nutrition Counseling | $50 – $150 per session | Often partially covered | Moderate; effective when combined with other lifestyle changes |

| Behavioral Therapy | $100 – $250 per session | Often partially covered | Moderate to high; addresses psychological factors contributing to weight gain |